Whoops! There were some problems with your input.

We have got you details been successfully. Finish below details to access our platform.

Browse through Sprowtt Crowdfunding Inc ’s available offering pages to find companies to invest in. To list on Sprowtt Crowdfunding Inc , companies are required to provide: pitch deck, business plan, financial statements, and formulation documents.

The regulations for accredited investors vary from one jurisdiction to the other and are often defined by a local market regulator or a competent authority. In the U.S, the definition of an accredited investor is put forth by SEC in Rule 501 of Regulation D.2

To be an accredited investor, a person must have an annual income exceeding $200,000 ($300,000 for joint income) for the last two years with the expectation of earning the same or a higher income in the current year. An individual must have earned income above the thresholds either alone or with a spouse over the last two years. The income test cannot be satisfied by showing one year of an individual's income and the next two years of joint income with a spouse.2

A person is also considered an accredited investor if they have a net worth exceeding $1 million, either individually or jointly with their spouse. The SEC also considers a person to be an accredited investor if they are a general partner, executive officer, or director for the company that is issuing the unregistered securities.2

An entity is considered an accredited investor if it is a private business development company or an organization with assets exceeding $5 million. Also, if an entity consists of equity owners who are accredited investors, the entity itself is an accredited investor. However, an organization cannot be formed with the sole purpose of purchasing specific securities. If a person can demonstrate sufficient education or job experience showing their professional knowledge of unregistered securities, they too can qualify to be considered an accredited investor.2

In 2020, the U.S. Congress modified the definition of an accredited investor to include registered brokers and investment advisors.3

On Aug. 26, 2020, the U.S. Securities and Exchange Commission amended the definition of an accredited investor. According to the SEC's press release, "the amendments allow investors to qualify as accredited investors based on defined measures of professional knowledge, experience or certifications in addition to the existing tests for income or net worth. The amendments also expand the list of entities that may qualify as accredited investors, including by allowing any entity that meets an investments test to qualify."

Among other categories, the SEC now defines accredited investors to include the following: individuals who have certain professional certifications, designations, or credentials; individuals who are “knowledgeable employees” of a private fund; and SEC- and state-registered investment advisors.4

Any regulatory authority of a market is tasked with both promoting investment and safeguarding investors. On one hand, regulators have a vested interest in promoting investments in risky ventures and entrepreneurial activities because they have the potential to emerge as multi-baggers in the future. Such initiatives are risky, may be focused on concept-only research and development activities without any marketable product, and may have a high chance of failure. If these ventures are successful, they offer a big return to their investors. However, they also have a high probability of failure.

On the other hand, regulators need to protect less-knowledgeable, individual investors who may not have the financial cushion to absorb high losses or understand the risks associated with their investments. Therefore, the provision of accredited investors allows access for both investors who are financially well-equipped, as well as investors who are knowledgeable and experienced.

There is no formal process for becoming an accredited investor. Rather, it is the responsibility of the sellers of such securities to take a number of different steps in order to verify the status of entities or individuals who wish to be treated as accredited investors.

Individuals or parties who want to be accredited investors can approach the issuer of the unregistered securities. The issuer may ask the applicant to respond to a questionnaire to determine if the applicant qualifies as an accredited investor. The questionnaire may require various attachments: account information, financial statements, and a balance sheet to verify the qualification. The list of attachments can extend to tax returns, W-2 forms, salary slips, and even letters from reviews by CPAs, tax attorneys, investment brokers, or advisors. Additionally, the issuers may also evaluate an individual’s credit report for additional assessment.

For example, suppose there is an individual whose income was $150,000 for the last three years. They reported a primary residence value of $1 million (with a mortgage of $200,000), a car worth $100,000 (with an outstanding loan of $50,000), a 401(k) account with $500,000, and a savings account with $450,000. While this individual fails the income test, they are an accredited investor according to the test on net worth, which cannot include the value of an individual's primary residence. Net worth is calculated as assets minus liabilities.

This person's net worth is exactly $1 million. This involves a calculation of their assets (other than their primary residence) of $1,050,000 ($100,000 + $500,000 + $450,000) less a car loan equaling $50,000. Since they meet the net worth requirement, they qualify to be an accredited investor.

The SEC defines an accredited investor as either:

an individual with gross income exceeding $200,000 in each of the two most recent years or joint income with a spouse or partner exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year.

a person whose individual net worth, or joint net worth with that person's spouse or partner, exceeds $1,000,000, excluding the person's primary residence.1

Are There Any Other Ways of Becoming an Accredited Investor?

Important Disclosure

StateCF is a DBA of Sprowtt, Inc., a technology provider facilitating intrastate capital-raising campaigns. StateCF is not a broker-dealer or a registered investment adviser and does not offer investment advice or solicit investments. All securities offerings are conducted by issuers on their own behalf. Sprowtt is a registered intermediary with the Florida Office of Financial Regulation "OFR". The software and/or domain that operates the site is through a site license agreement. Sprowtt may charge the issuer who lists an offering on this site a commission or fee to use the site, which will be disclosed to investors through the issuer offering registration filed with the "OFR".

Investing in private companies involves significant risks. Investors should be aware of the following:

This platform is intended for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities.

Statecf.com is regulated by the Florida Office of Financial Regulation (OFR). Sprowtt has been a registered State of Florida Funding Portal since 2018. Sprowtt.com is a website operated by Sprowtt Inc., which provides compliance software on a subscription basis with tools and technology to a variety of entities within the state of Florida for Florida intrastate offerings, including issuers, broker-dealers, investment advisers, attorneys, and financial institutions.

By accessing this website and any pages on this website, you agree to be bound by its Terms of Use, Privacy Policy, Service Level Agreement, and other policies made available on this website.

Please note the following regarding our operations:

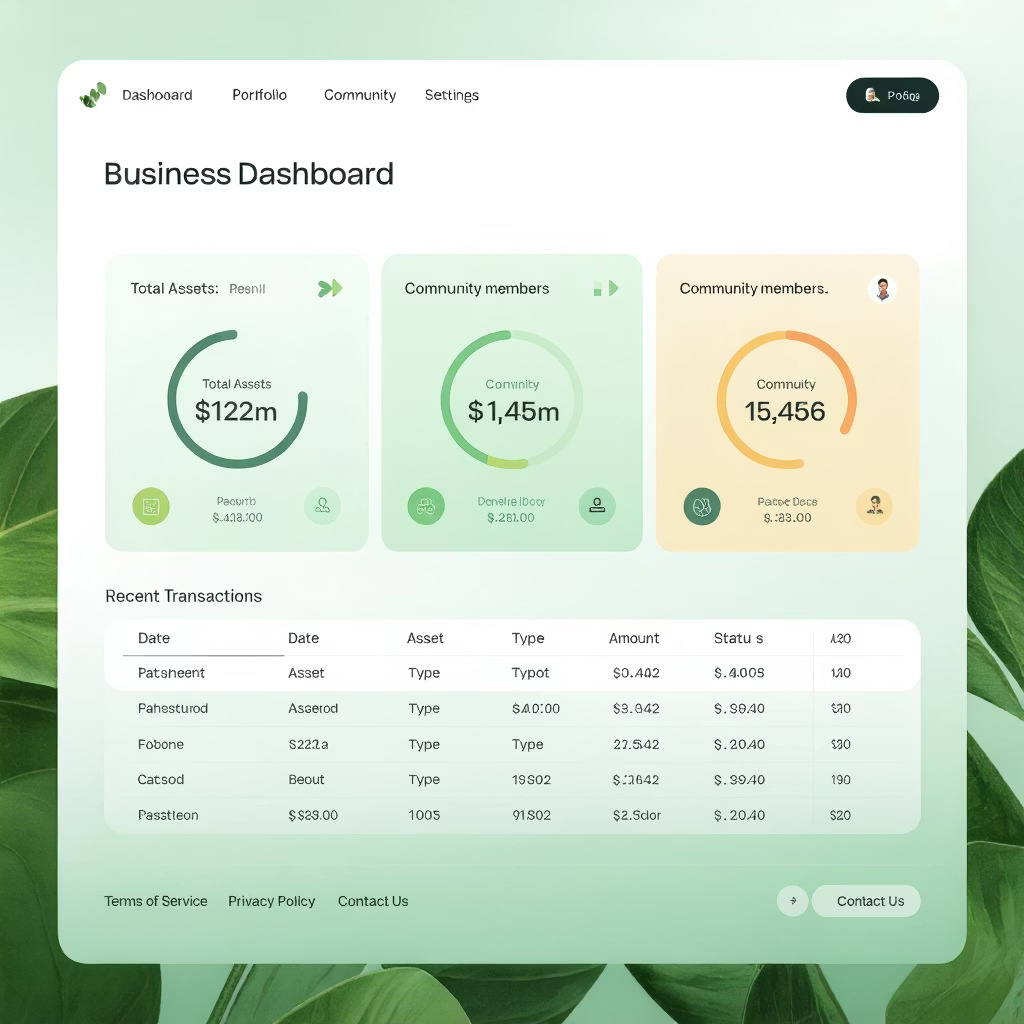

Our comprehensive platform connects companies, investors, and community members through an intuitive dashboard system. Users can access deal rooms, manage communications, and track investment opportunities all in one centralized location.

The system provides real-time tracking of company shares, investor login activity, and payment status updates. Member firms can monitor their portfolio performance while maintaining secure access to critical business information.

Local businesses join our platform to access funding opportunities

Connect with qualified investors interested in local growth

Secure deal rooms facilitate transparent transactions

Track progress and celebrate local economic development

Local businesses seeking investment opportunities and growth capital through our secure platform

Qualified investors looking to support local economic development and community growth

Secure spaces for transparent negotiations and document sharing between all parties

Streamlined messaging system connecting stakeholders throughout the investment process

Complete the Ambassador application form.

Upload a resume and portfolio samples.

Participate in a short virtual interview.

Attend orientation and training sessions.

Join StateCF's dedicated community and help shape the future of our "Invest Local" initiative. As an Ambassador, you will play a pivotal role in identifying and referring impactful businesses, ranging from groundbreaking projects developing cancer-fighting drugs to innovative consumer solutions. You will contribute to our mission and receive exclusive coaching from the Founder and other key StateCF team members. This empowers you to drive our nonprofit 501(c)(3) mission and become part of something truly significant. Apply for our Ambassador Program below and join this transformative journey.

In a detailed explanation (maximum 2,500 words), describe:

Existing StateCF Ambassadors should use the designated forms for submitting reimbursement requests or documenting in-kind services. This ensures the efficient and accurate processing of your valuable contributions.

These forms are conveniently accessible through your Ambassador Portal.

If you email me more than one paragraph I will respond asking you to condence your message